By signing a mortgage loan agreement, a borrower is committing to pay a charge up front in exchange for the promise of future cash flow. Your interest rate is the name given to this charge. The interest rate is a major factor to think about when applying for a loan, as it determines how much money you will have to pay back in total. Different from mortgages, house loans are secured by the borrower’s existing equity in the property being acquired. The lender has seized legal possession of the borrower’s assets (the collateral) in exchange for a loan.

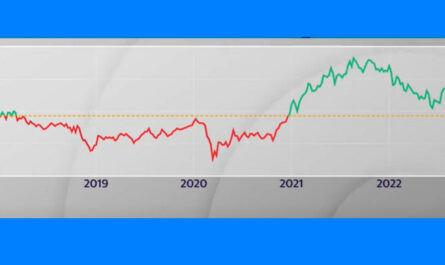

A major contributor to this trend’s evolution was the general reduction in competitiveness. Borrowers found themselves on more solid footing as a result of new lenders entering the market. There was intense competition among these new financial institutions to provide the most attractive mortgage loan interest rates available. It’s possible to get a better interest rate on a home loan if you’re able to keep up with the frequent changes that banks make. It is to your advantage to shop around for the best interest rate, as banks compete for your business by offering comparatively low rates. Clients lacked “negotiating power” as compared to financial institutions before the advent of the Internet.

The interest rate you’re offered on a home loan could be influenced by the details listed in your credit report. The report includes information on your past and present payment habits, credit standing, bankruptcy filings, and credit history. Furthermore, your credit score will improve by one point whenever you add a new creditor.

This is crucial since having multiple lenders check your credit at once raises your risk of being rejected for credit or issued a loan at a higher interest rate. This is a bad situation when both of these things happen. Lenders may check your credit history when you apply for a mortgage, personal loan, credit card, or other forms of credit. Be aware that a lender can’t view your credit report unless they have your permission to do so. There is no way to overlook the significance of this information.

Similar to the savings you would see from making bulk purchases, taking out a loan can help you save money. One of the advantages you may enjoy is a lower interest rate. Loan rates for homes vary based on several factors, including the borrower’s credit history, the property’s expected rental income, and whether or not the home will be used as a primary residence. Typically, the most significant savings go to those who have lived in their current home the longest.

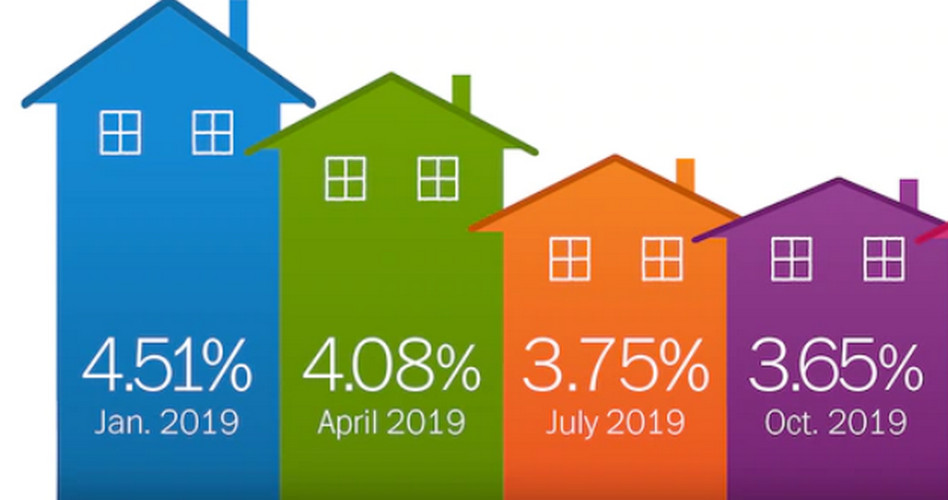

Financial institutions such as banks require interest payments to cover the expenses incurred when lending money. As a result, changes in the level of prices are the direct cause of interest rate shifts. Interest rates may take the cost of conducting financial transactions into account. same as how the cost of doing business in one state can be affected by the laws and regulations imposed by another state.